What is an example of deferred?

Table of Contents

- What is an example of deferred?

- What is a deferred transaction?

- What are deferred charges examples?

- What is an example of deferral accounting?

- Is Deferred cost an asset?

- What is the difference between prepaid and deferred?

- How will you're execute a deferred transaction?

- Is deferred cost an asset?

- Is deferred charges an asset?

- Which is an example of a deferred expense?

- Which is an example of a deferral of revenues?

- What's the difference between a deferred payment and a loan?

- Where does deferred revenue go on a balance sheet?

What is an example of deferred?

The definition of deferred is put off or delayed. An example of deferred is a project that has been put on the back burner. An example of deferred is income or interest which will be not be paid until a certain date. Having the rights, interest, or payment withheld until a certain date.

What is a deferred transaction?

A deferred transaction is a transaction that is uncommitted when the roll forward phase finishes and that has encountered an error that prevents it from being rolled back. Because the transaction cannot be rolled back, it is deferred. ... However, an error at the file level can also cause deferred transactions.

What are deferred charges examples?

Long-term prepayments that are chargeable to several years are presented on the balance sheet as deferred charges. Typical examples are prepaid rent, prepaid insurance, and supplies.

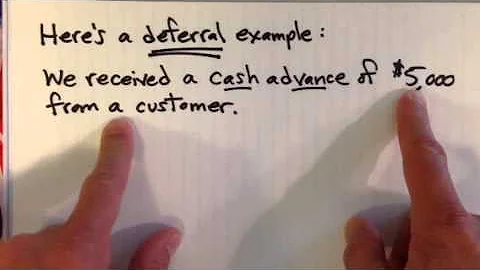

What is an example of deferral accounting?

A deferral of an expense or an expense deferral involves a payment that was paid in advance of the accounting period(s) in which it will become an expense. An example is a payment made in December for property insurance covering the next six months of January through June.

Is Deferred cost an asset?

Since a business does not immediately reap the benefits of its purchase, both prepaid expenses and deferred expenses are recorded as assets on the balance sheet for the company until the expense is realized.

What is the difference between prepaid and deferred?

Prepaid expenses are listed on the balance sheet as a current asset until the benefit of the purchase is realized. Deferred expenses, also called deferred charges, fall in the long-term asset category.

How will you're execute a deferred transaction?

Executing a Deferred Transaction When you build a deferred transaction, the transaction is added to the deferred transaction queue at your local site. The remote procedures are not executed until this queue is pushed. You can either schedule this queue to be pushed at a periodic interval, by calling DBMS_DEFER_SYS.

Is deferred cost an asset?

Since a business does not immediately reap the benefits of its purchase, both prepaid expenses and deferred expenses are recorded as assets on the balance sheet for the company until the expense is realized.

Is deferred charges an asset?

Example of a Deferred Charge To receive a discount, some companies pay their rent in advance. This advanced payment is recorded as a deferred charge on the balance sheet and is considered to be an asset until fully expensed. ... Prepaid expenses are a current account, whereas deferred charges are a non-current account.

Which is an example of a deferred expense?

Deferred expenses, also called prepaid expenses or accrued expenses, refer to expenses that have been paid but not yet incurred by the business. Common prepaid expenses may include monthly rent or insurance payments that have been paid in advance.

Which is an example of a deferral of revenues?

The amount that expires in an accounting period should be reported as Insurance Expense. A deferral of revenues or a revenue deferral involves money that was received in advance of earning it. An example is the insurance company receiving money in December for providing insurance protection for the next six months.

What's the difference between a deferred payment and a loan?

It all depends on the terms of the deferred payment plan. There is a difference between deferred payments and loans. A deferred payment plan is not a loan. Loans have interest that you also need to pay in addition to the purchase price of the item.

Where does deferred revenue go on a balance sheet?

Meanwhile, the deferred revenue must be reflected on the balance sheet as a liability account. Let’s say, your business receives payment from the customer for the month of subscription to your service, which costs $40. You should record the entire amount as the deferred revenue.

Main Topics

Main Topics