What is deposit multiplier how is it calculated?

Table of Contents

- What is deposit multiplier how is it calculated?

- What is the simple money deposit multiplier?

- What do you mean by money multiplier?

- What is the formula for the deposit multiplier?

- How to calculate a simple money multiplier formula?

- How does the deposit multiplier affect the money supply?

- How is the deposit multiplier related to the reserve requirement?

What is deposit multiplier how is it calculated?

The deposit multiplier is the ratio of the maximum possible change in deposits to the change in reserves. When banks in the economy have made the maximum legal amount of loans (zero excess reserves), the deposit multiplier is equal to the reciprocal of the required reserve ratio (m=1/rr m = 1 / r r ).

What is the simple money deposit multiplier?

The deposit multiplier is also called the deposit expansion multiplier or the simple deposit multiplier. This is the amount of money all banks must keep on hand in their reserves. ... These are known as the required reserve or reserve requirement—the amount of money available for a bank to lend to its customers.

What do you mean by money multiplier?

In monetary economics, a money multiplier is one of various closely related ratios of commercial bank money to central bank money (also called the monetary base) under a fractional-reserve banking system. ... This multiple is the reciprocal of the reserve ratio minus one, and it is an economic multiplier.

What is the formula for the deposit multiplier?

The money retained by the bank as a proportion of the total deposits is known as the “Required reserve ratio”, and the formula for deposit multiplier is expressed as the reciprocal of the required reserve ratio. Mathematically, it is represented as, Deposit Multiplier = 1 / Required Reserve Ratio

How to calculate a simple money multiplier formula?

Money Multiplier Formula. To calculate the formula under current regulations, take the full amount of money in your bank and eliminate the first $16 million. So if your bank had $100 million, you would subtract $16 million, for a total of $84 million. This amount would be the total every day susceptible to reserve requirements.

How does the deposit multiplier affect the money supply?

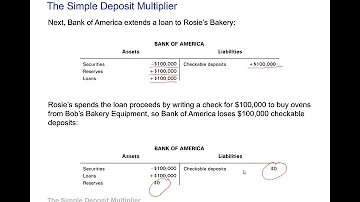

The deposit multiplier is part of the money supply expansion activity by a bank made possible with fractional reserve banking. Banks create money, or expand the money supply, in the form of checkable deposits by multiplying their required reserve amount into a larger amount of deposits.

How is the deposit multiplier related to the reserve requirement?

BREAKING DOWN 'Deposit Multiplier'. The term "multiplier" refers to the fact that the change in checkable deposits resulting from the bank lending money to borrowers is a multiple of any change in the bank's level of reserves. The deposit multiplier is thus inextricably tied to the bank's reserve requirement.

Main Topics

Main Topics