How can monetary policy be used to solve a recession?

Table of Contents

- How can monetary policy be used to solve a recession?

- What does monetary policy do during a recession?

- Why is monetary policy effective during a recession?

- Is monetary policy effective in recession?

- How can we fix recession?

- How do you get out of a recession?

- Who controls monetary policy?

- What are the weaknesses of monetary policy?

- What does the Central Bank do in a recession?

- How does monetary policy work in a recession?

- What can the Fed do to prevent a recession?

- How is monetary policy conducted in the United States?

How can monetary policy be used to solve a recession?

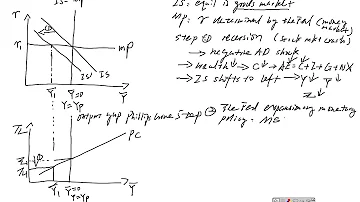

If recession threatens, the central bank uses an expansionary monetary policy to increase the supply of money, increase the quantity of loans, reduce interest rates, and shift aggregate demand to the right.

What does monetary policy do during a recession?

Monetary policy is under the control of the Federal Reserve System (our central bank) and is completely discretionary. It is the changes in interest rates and money supply to expand or contract aggregate demand. In a recession, the Fed will lower interest rates and increase the money supply.

Why is monetary policy effective during a recession?

Monetary policy can offset a downturn because lower interest rates reduce consumers' cost of borrowing to buy big-ticket items such as cars or houses. For firms, monetary policy can also reduce the cost of investment. ... As a result, the effect of fiscal stimulus on household and business spending may come too late.

Is monetary policy effective in recession?

Conceptually, monetary policy transmission may be weaker when interest rates are low for at least two reasons. ... Specifically, persistently low interest rates often prevail in the wake of balance sheet recessions, such as in the aftermath of the GFC.

How can we fix recession?

Solutions to an Economic Recession

- Reduce Taxes. When governments reduce taxes, it often comes at the cost of widening the budget deficit. ...

- Increase in Government Spending. ...

- Quantitative Easing. ...

- Reduce Interest Rates. ...

- Remove Regulations.

How do you get out of a recession?

Thankfully, there are ways you can prepare for an economic recession:

- Live within you means.

- Identify ways to cut back on spending.

- Grow your emergency savings.

- Sell your unwanted stuff.

- Pay down your debts.

- Take advantage of relief programs.

- Do not panic sell.

- Improve your education and skills.

Who controls monetary policy?

Congress has delegated responsibility for monetary policy to the Federal Reserve (the Fed), the nation's central bank, but retains oversight responsibilities for ensuring that the Fed is adhering to its statutory mandate of “maximum employment, stable prices, and moderate long-term interest rates.” To meet its price ...

What are the weaknesses of monetary policy?

List of the Disadvantages of Monetary Policy Tools

- They do not guarantee economic growth. ...

- They take time to begin working. ...

- They always create winners and losers. ...

- They create a risk of hyperinflation. ...

- They create technical limitations. ...

- They can hurt imports. ...

- They do not offer localized supports or value.

What does the Central Bank do in a recession?

If recession threatens, the central bank uses an expansionary monetary policy to increase the money supply, increase the quantity of loans, reduce interest rates, and shift aggregate demand to the right.

How does monetary policy work in a recession?

While it can be used to nudge the economy out of recession (or otherwise influence its course), it can also make things a lot worse. The Fed has to be extremely careful in its actions in order to avoid economic catastrophe. In the end, the course of a nation's recession is controlled by the actions of everybody living in the country.

What can the Fed do to prevent a recession?

There are four major things the Fed can do to curb a recession: Reduce the reserve ratio - If banks don't have to keep as high a percentage of their assets in reserves, they have more accessible money. This might lead them to offer more attractive loans to their customers, which can help boost economic growth.

How is monetary policy conducted in the United States?

In the United States, monetary policy is conducted by the Federal Reserve System, commonly called the Fed. The Fed is the nation's central banking institution; it is the bank for the government itself, as well as for national commercial banks.

Main Topics

Main Topics