What is one major difference between absorption and variable costing and why would a company choose one over the other for internal decision making?

Table of Contents

- What is one major difference between absorption and variable costing and why would a company choose one over the other for internal decision making?

- What is the difference between full absorption costing and variable costing quizlet?

- What is the difference between full absorption costing and variable costing chegg?

- What is the basic difference between direct costing and absorption costing?

- What does variable costing include?

- What is a mixed cost accounting?

- Which of the following is a valid reason for using variable costing?

- How are fixed and variable costs treated in absorption costing?

- What's the difference between variable and absorption accounting?

- What is the difference between marginal costing and absorption costing?

- How is the unit cost of absorption calculated?

What is one major difference between absorption and variable costing and why would a company choose one over the other for internal decision making?

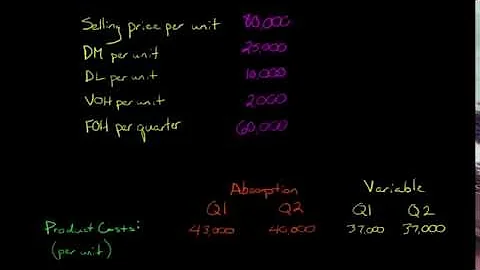

The value of inventory under absorption costing includes direct material, direct labor, and all overhead. The difference in the methods is that management will prefer one method over the other for internal decision-making purposes. The other main difference is that only the absorption method is in accordance with GAAP.

What is the difference between full absorption costing and variable costing quizlet?

Variable Costing; ALSO KNOWN AS DIRECT COSTING Method whereby only variable manufacturing costs are included as inventorial able costs. ... To summarize, the main difference between variable costing and absorption costing is the accounting for fixed manufacturing costs - this will always be the difference.

What is the difference between full absorption costing and variable costing chegg?

In full absorption costing, all of the non-manufacturing costs are expensed. In variable costing, all of the non-manufacturing expenses are included in the cost of the product.

What is the basic difference between direct costing and absorption costing?

The fundamental difference between the two systems is one of timing. The direct costing model takes all the fixed cost to the income statement immediately. The absorption costing model assigns the fixed cost to units produced during the period.

What does variable costing include?

Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the product-cost of production. ... It not only includes the cost of materials and labor, but also both, in which the fixed manufacturing overhead is allocated to products produced.

What is a mixed cost accounting?

Mixed costs are costs that contain a portion of both fixed and variable costs. ... You may be charged a fixed amount each month for data usage or text messages allowed but when you exceed your limit, you are charged a set amount (variable cost) based on each text message or gigabyte of data you use over your limit.

Which of the following is a valid reason for using variable costing?

Which of the following is a valid reason for using variable costing? (2pts) Fixed production cost should be ignored when costing units of inventory since it is not essential to the production process. ... Under variable costing managers can increase profitability by increasing the volume of production.

How are fixed and variable costs treated in absorption costing?

In an absorption costing system, both the fixed and variable costs are regarded as product related cost. In this method, the objective of the assignment of the total cost to cost centre is to recover it from the selling price of the product.

What's the difference between variable and absorption accounting?

Variable costing requires companies to expense fixed costs in the accounting period when they occur. The absorption method, however, adds fixed costs to the production system, ultimately allocating the costs to manufactured products. Income reporting is one major difference between these two costing methods.

What is the difference between marginal costing and absorption costing?

Allocation of total costs to the cost center to determine the total cost of production is known as Absorption Costing. Variances in the opening and closing stock do not influence the cost per unit of output. Variances in the opening and closing stock affect the cost per unit. Presented to outline the total contribution of each product.

How is the unit cost of absorption calculated?

Absorption Costing: $5 + $4 + $1 + $4* = $14. Variable Costing: $5 + $4 + $1 = $10. * $20,000 / 5,000. Notice that the fixed manufacturing overhead cost has not been included in the unit cost under variable costing system but it has been included in the unit cost under absorption costing system.

Main Topics

Main Topics